Form CSR – 2, notified vide GSR 107(E) on 11 February 2022, is on our desk to fill and file. If you have missed the information overflow, the last date for filing the same for the financial year ended on 31 March 2021 is 31 March 2022. I am not sure of the mechanism, but it may be an attachment of Form GNL – 2.

It seems next year onward; this will be an addendum, not the attachment, to Form AOC – 4/ AoC – 4 XBRL/ AoC – 4 NBFC (Ind AS).

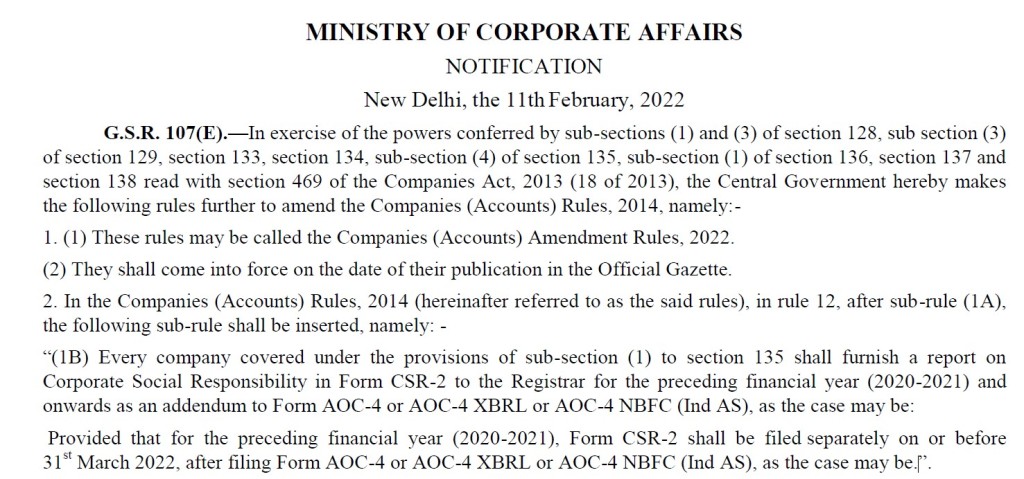

We cannot wait but to prepare the data to fill for all of our valuable clients – every company covered under the provisions of sub-section (1) to section 135. Please refer to the newly inserted Rule 12(1B) of the Companies (Accounts) Rules, 2014.

List of Documents for support:

- Copies of Audited Balance Sheet of last three financial years;

- Form AOC – 4/ AoC – 4 XBRL/ AoC – 4 NBFC (Ind AS) filed for the financial year [referred hereinafter as AOC-4];

- Form MGT – 7 filed for the financial year;

- Paid Challan for Form AOC – 4/ AoC – 4 XBRL/ AoC – 4 NBFC (Ind AS) filed for the financial year [referred hereinafter as Challan];

- Latest Board Resolution constituting CSR Committee;

- Constitution of CSR Committee;

- Minutes of CSR Committee Meetings held during the financial year [FY 2020-21;

- Company Website with Compliance menu and CSR Tab thereunder;

- Impact Assessment Report of each CSR Project;

- CSR Ledger and CSR Bank Account Statement for the financial year;

- Bank Statement of Unspent CSR Account for previous three financial years;

- Annual Action Plan CSR for the last financial year; and

- The Implementation Reports for each of the CSR Projects as on 31 March of the financial year with minutes of the CSR Committee meeting considering the same [For all projects completed during the last financial year or ongoing as on 31 March of the financial year].

Information to Fill:

The net worth, turnover, and net profit data should be the same as Form AOC – 4 filed for the financial year.

Meeting details of the CSR Committee should confirm the details from the latest Board Resolution constituting the CSR Committee and Minutes of the meeting of CSR Committee held during last Financial Year.

The Impact assessment report should be on your desk for confirmation and on the company’s website at least before you fill out the Form. The weblink should be in working condition. I am not sure if the link’s implication got broken in the future. Therefore, it is advisable to attach the report with the Form.

The set-off amount should be taken from the balance sheet or confirmed by your auditor.

The company should confirm CSR obligation with audited balance sheets of the last three financial years.

Details of each (A) Ongoing project started in previous years completed in Financial year, (B) Ongoing project started in previous years still not completed in Financial year and (C) project initiated and completed during the Financial Year:

- Project ID;

- Item number from Schedule VII – CSR Schedule;

- Name of Project;

- Local Area – Yes/No;

- Location of the Project – State and district

- Project duration in months;

- Amount spent during the financial year;

- Mode of implementation – direct or indirect;

- Name and CSR Registration Number of the Implementation Agency;

- Amount paid on administrative overhead

- Amount spent on impact assessment

- Total amount spent during the year

- Amount spent more than the obligation;

- Amount unspent; and

- Amount transferred to the Scheduled Fund.

Details of Unspent Fund for the financial year:

- Details of the amount transferred to Unspent CSR Account; and

- Details of the amount transferred to Scheduled Funds.

Details of the amount spent in the financial year from the unspent fund of previous three financial years

- Year-wise amount transferred to Unspent CSR Fund;

- Year-wise balance of the amount transferred to Unspent CSR Fund;

- Amount spent in the financial year;

- Amount transferred to Scheduled Fund; and

- Year-wise Remaining amount for the year.

Initial Impact assessment of CSR-2

The Form is my hate of first sight due to the complication of data required. Please get the filled Form vatted by a qualified professional, including auditors. In addition, the Form is so demanding it will be easier to transfer your social responsibility amount to the Government pet funds listed in Schedule VII.

The government is pretending to promote and protect the MSME Sector. A Company with a turnover of less than 100 Crore and investment in plant and machinery of less than 20 is an MSME company. Good numbers of MSME companies are CSR companies. These companies do not have an efficient mechanism to undertake and implement CSR projects. With the present detailed Form, we are opening gates for tax assessment like monitoring social contribution. With the implementation of burdensome Form, we are forcing MSMEs to transfer funds to certain government-sponsored funds. These funds have doubtful answerability towards constitutional auditors (CAG) and constitutional stakeholders (the parliament).

Tax terrorism must be an ancient term by now. Social services are not voluntary anymore but increasingly subject to regulatory control and reporting.

In continuation of my earlier appeals, I beg ease of doing CSR. Please believe in your people and corporate citizens. But unfortunately, the compliance, reporting, monitoring and prosecution cost will be higher than possible leakage. Therefore, society will not get benefits from being overburdened.