The Discussion Paper on Streamlining the Liquidation Process, dated 14 June 2022, issued by the Insolvency and Bankruptcy Board of India, is a well-intended step with some corrective measures.

Stakeholders’ Consultation Committee

Section 53 of the Insolvency and Bankruptcy Code, 2016, empowers the Liquidator to consult any stakeholder entitled to a distribution of proceeds. The Liquidation Regulations have already converted the Liquidator’s power to consult any stakeholders into a duty. Increasingly such consultation is binding on the Liquidator unless a contrary decision is well explained and reported. I welcome a consultation committee meeting to increase transparency and democratic decision-making.

The present discussion paper intends to facilitate the consultation at an early stage and remove discrepancies.

Proposal 1: In this regard, it is proposed that the CoC as constituted during CIRP on the basis of admitted claims shall function as SCC during liquidation process with the voting share of members of SCC being same as that in the CoC. The stakeholders who are part of CoC without voting rights will be part of SCC without voting rights. The Liquidator shall convene first meeting of SCC within seven days of liquidation commencement date.

Draft Regulation: “(1A) The committee of creditors under section 21 shall function as the consultation committee with same voting rights till its constitution under sub-regulation (1).

Provided the directors, partners and one representative of operational creditors, as referred in sub-section (3) of section 24, may attend the meetings, but shall not have any right to vote in such meetings”

“(2) The voting share of members of the consultation committee under sub-regulation (1) shall be proportionate to the share of payments they will receive in terms of Section 53 against their admitted claim during liquidation if the liquidation value is taken as the proceeds for sale.

Provided a secured creditor who has not relinquished their security interests under section 52 shall not be part of the consultation committee under regulation (1) or (1A), as the case may be.

Provided further, the representatives of stakeholders not having voting share in the consultation committee may attend the meetings, but shall not have any right to vote in such meetings”

I have one suggestion: the composition of this “Interim Stakeholders’ Consultation Committee” should be constituted by adjusting the composition per entitlement to a distribution of proceeds under Section 53. In addition, the voting powers of the Interim Stakeholders’ Consultation Committee and regular Stakeholders’ Consultation Committee should be aligned.

I suggest amendments in draft sub-regulations (1A) and (2) as under:

“(1A) The committee of creditors under section 21 shall function as the consultation committee with same voting rights till its constitution under sub-regulation (1).

“(2) The voting share of members of the consultation committee under sub-regulation (1) or (1A) shall be proportionate to the share of payments they will receive in terms of Section 53 against their admitted claim during liquidation if the liquidation value is taken as the proceeds for sale.

Proposal 2: The Liquidator shall record the reason of his decision contrary to the advice of the Stakeholders’ Consultation Committee in writing and forward the same to the Adjudicating Authority and the Board within five days.

This will increase the cost in the form of one more application before the Adjudicating Authority takes such a report on record. Further, it will reduce decisions based on the Liquidator’s commercial wisdom.

Proposal 3: A secured creditors shall intimate its decision regarding realisation or relinquishment of its security interest under section 52 of the Code, in the first meeting of the SCC (practically Interim SCC).

Draft Regulation: “(1) A secured creditor shall inform the Liquidator of its decision to relinquish its security interest to the liquidation estate or realise its security interest within seven days from the liquidation commencement date or in the first meeting of the consultation committee, whichever is later:

Provided that, where a secured creditor does not intimate its decision within seven days from the liquidation commencement date or in the first meeting of the consultation committee, whichever is later, the assets covered under the security interest shall be presumed to be part of the liquidation estate.”

This is a welcome step assuming the secured creditors have filed a claim in the CIRP and part of the Interim SCC). Such secured creditors have enough time to decide after the liquidation resolution and before the Liquidation order. I suggest the status quo in case of secured creditors who, for any reason, have not filed a claim in CIRP.

A second proviso may be added:

Provided also that a secured creditor, who have not filed its claim in the CIRP, shall inform the Liquidator of its decision to relinquish its security interest to the liquidation estate or realise its security interest, as the case may be, in Form C or Form D of Schedule II.”

Proposal 4: The Stakeholders’ Consultation Committee shall now empower to propose replacement of the Liquidator.

This will not be an appropriate step; First it is not in line with the Code; Second the SCC is only a consultative body and thirdly the SCC may replace a hard-working liquidator facilitating the incumbent Liquidator to have the fruit of the Liquidation.

The Code may be amended for the replacement of the Liquidator by the Adjudicating Authority when the Stakeholders’ Consultation Committee applies for such replacement with specific and justified reasons. The Liquidator should have a right to be heard before the SCC and the AA.

Proposal 5: SCC will fix/review the fee of the Liquidator in its first meeting.

I do not see a good reason for this proposal as present regulations adequately cover the fee aspect. In addition, this proposal will open endless negotiations between Liquidator and the stakeholders.

Compromise or Arrangement

Proposal 6: reduction of time period for the Compromise and Arrangement from 90 days to 30 days.

The discussion paper mentions that as of 31 May 2022, only eight liquidation processes have been closed by way of compromise or arrangement under section 230 of the Act, which took an average of 466 days for completion, and the Liquidator has realised only 87% of the liquidation value in these eight cases.

These eight cases are enough to say the reduction of this period may not change the situation as compromise and arrangement is otherwise a time-consuming process. Therefore, such a decrease in time shall promote the auction of the company as a going concern.

Valuation

Proposal 7: Where the Liquidator is of the opinion that fresh valuation is required, he shall seek advice of SCC for the same and such valuation may be considered for subsequent auctions.

This amendment is a welcome step.

Submission of Progress Reports and SCC Minutes

Proposal 8: The Liquidation Regulations may be amended to provide that the Liquidator shall submit the copy of progress reports, along with the minutes of the SCC, with the Board as and when the same is filed with AA. Further, the format of the Progress report, along with its contents, may be provided in detail by way of a Circular.

This proposal is just a procedural addition and may become an example of over governance.

Events-based timelines of Auction

Proposal 9 and 10: Frist auction notice within 45 days of the Liquidation Commencement Date, Auction on 35th day from the public notice and successive auction notice within 15 days of the failed auction.

These proposals may bring procedural uniformity and predictability to the process. However, the gap between successive auction notice and the auction may be reduced to 15-20 days from the proposed 35 days each time. Most of the participants in successive auctions usually working on their proposal/bids from the first or earlier auctions.

Same time, IBBI may also give more power to SCC to consider proposals for private sales provided such private sales should not hamper transparency in the process. Many potential buyers prefer private sale over auction purchases.

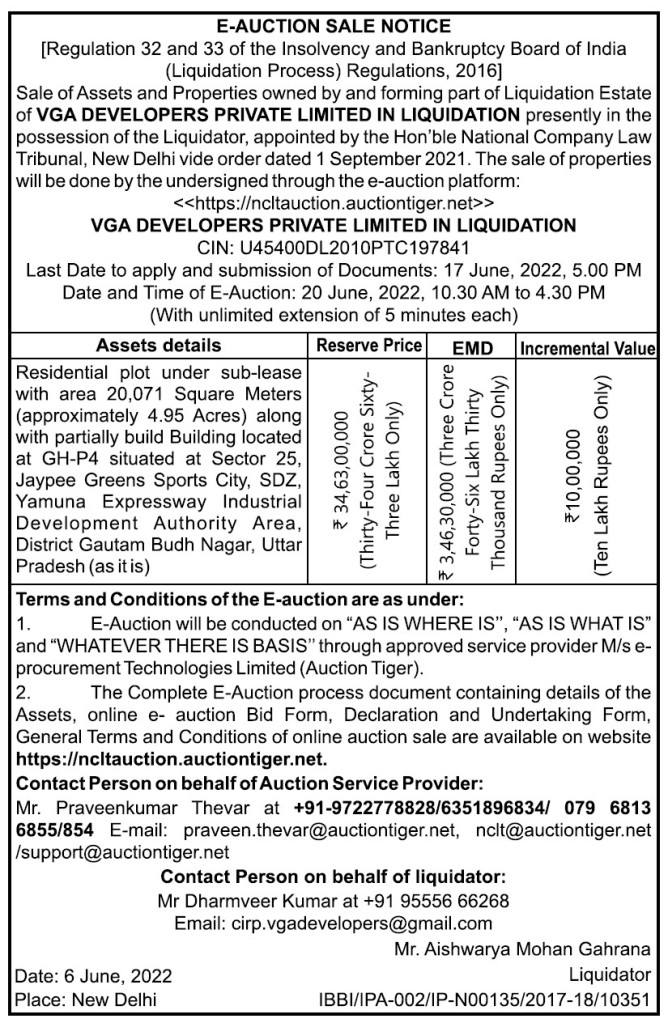

Designating Auction Portal

Proposal 11: The Liquidation Regulations may provide that the auction platforms of PDAs as empanelled from time to time may be exclusively designated for offering auction services.

I restrain myself from making any comment on this proposal.

Preparation of Asset Memorandum

Proposal 12: The Liquidator shall use the information provided in IM and valuation conducted during CIRP for preparation of Asset Memorandum and submit the same to AA within 30 days. Further, the Liquidator shall share the asset memorandum with the SCC after receiving confidentiality undertaking from the members of the SCC.

This proposal is good for transparency and proper advisory by the Stakeholders’ Consultation Committee.

Interim Finance availed during CIRP

Proposal 13: The liquidation cost shall include the interest on interim finance till the same is repaid.

This proposal is welcome.

Treatment of Avoidance Applications

Proposal 14: Before filing of an application of dissolution or closure of the process by Liquidator, SCC shall decide the manner in which proceedings in respect of avoidance transactions or fraudulent or wrongful trading, if any, will be pursued after closure of liquidation proceedings and the manner in which the proceeds, if any, from such proceedings shall be distributed. This decision shall be part of the final report filed before the AA.

I am not sure about the effectiveness of the proposal, but hopeful.

Claims

Proposal 15: The Liquidator shall consider the claims collated during the CIRP in respect of claimant who have not submitted their claim during liquidation.

This proposal is a welcome step, but it is always advisable for claimants to file fresh claims.

Disclaimer: The writer is an Insolvency Professional, and his interest may impact the outcome of this discussion.

I am publishing this on the blog for discussion purposes. I will submit my final thought with IBBI one or two days before the last date.

Aishwarya Mohan Gahrana, Company Secretary and Insolvency Professional

To Join my telegram Channel: https://t.me/AishMGhrana

To Join my telegram discussion group (only for CA/CS/CMA/IP/RV): https://t.me/AishMGhrana